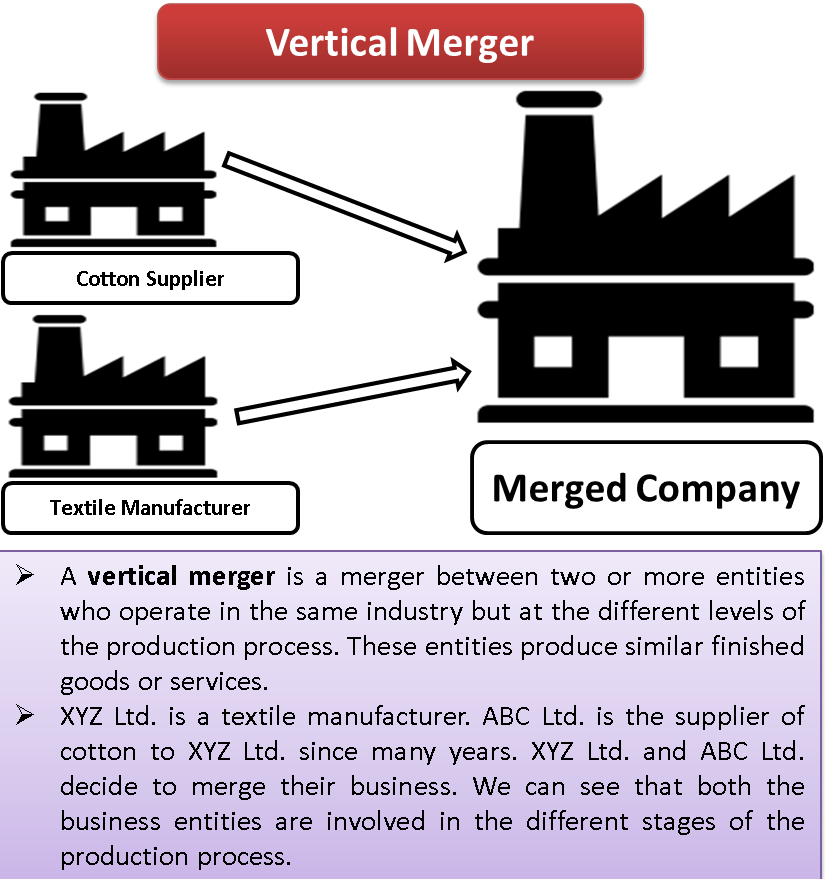

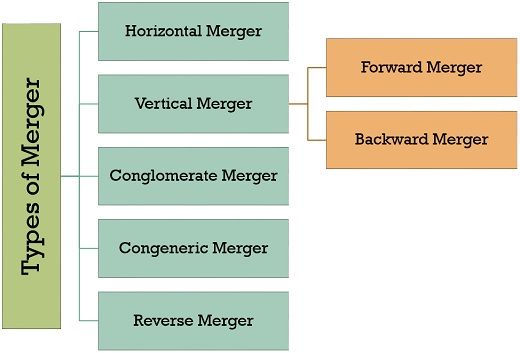

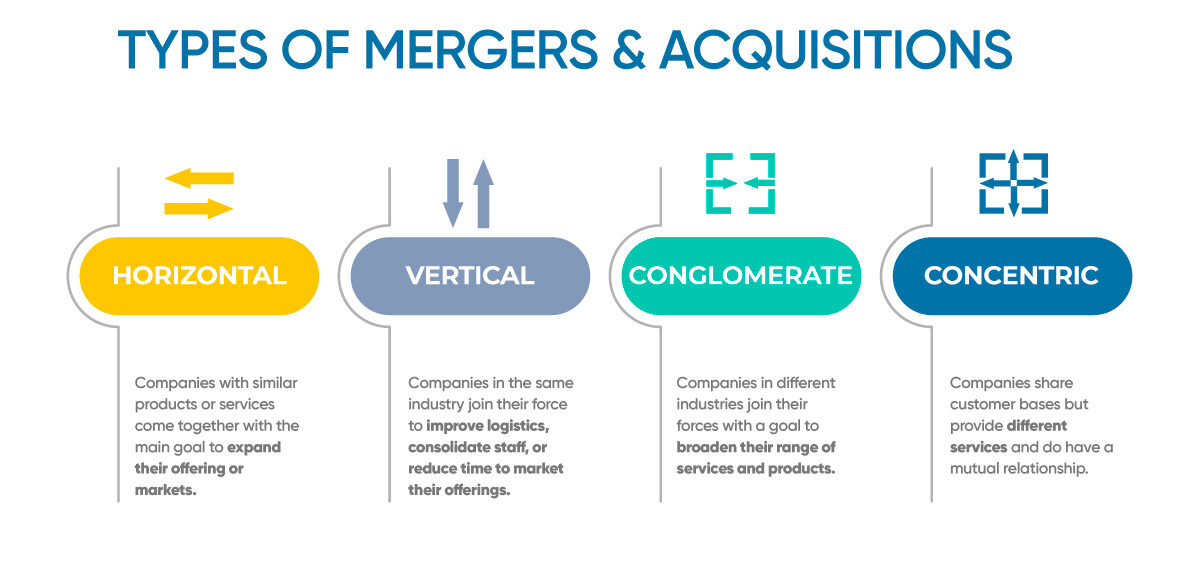

A vertical merger is a type of corporate merger that occurs between two companies that operate at different stages of the same production process. For example, a company that manufactures car parts may merge with a company that assembles cars. The resulting company would be able to control the entire production process, from the raw materials to the finished product.

One example of a vertical merger is the acquisition of Pfizer by Warner-Lambert in 2000. Pfizer, a pharmaceutical company, merged with Warner-Lambert, a consumer healthcare company, in order to expand its product offerings and increase its market share. Prior to the merger, Pfizer focused primarily on prescription drugs, while Warner-Lambert focused on over-the-counter (OTC) products such as Listerine mouthwash and Halls cough drops. By combining forces, the two companies were able to offer a more comprehensive range of healthcare products, including both prescription and OTC options.

Another example of a vertical merger is the acquisition of Nestlé by Gerber in 2007. Nestlé, a food and beverage company, merged with Gerber, a baby food manufacturer, in order to expand its presence in the baby food market and gain access to Gerber's distribution channels. Prior to the merger, Nestlé had a strong presence in the adult food and beverage market, but had a relatively small presence in the baby food market. By acquiring Gerber, Nestlé was able to increase its market share and reach in the baby food industry, as well as diversify its product offerings.

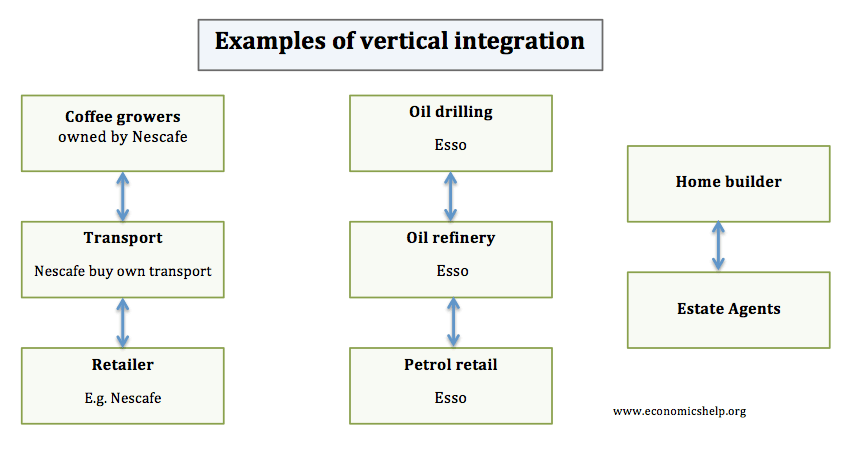

Vertical mergers can provide numerous benefits to the companies involved. For example, they can allow a company to integrate its supply chain and control the quality of its raw materials, leading to cost savings and increased efficiency. They can also enable a company to enter new markets or expand its existing market presence by gaining access to new customers and distribution channels. In addition, vertical mergers can help to reduce competition by eliminating a potential rival from the market.

However, vertical mergers can also raise concerns about potential anti-competitive effects. For example, if a company that controls a significant portion of the supply chain for a particular product merges with a company that sells that product, it may be able to raise prices or limit access to the product for its competitors. As a result, vertical mergers are often subject to regulatory scrutiny to ensure that they do not result in harmful effects on competition and consumers.