Retrenchment compensation, also known as severance pay, is a financial benefit provided to employees who have been terminated from their jobs due to a company's restructuring or downsizing. Retrenchment compensation is meant to provide financial support to employees as they transition to new employment or training opportunities, and to compensate them for the loss of their job.

There are several factors that can determine the amount of retrenchment compensation an employee may receive. These can include the employee's length of service, their position within the company, and the reason for the retrenchment. In some cases, retrenchment compensation may be based on the employee's salary or wages, with a higher amount being provided to employees who have been with the company for a longer period of time or who hold higher-level positions.

Retrenchment compensation may also be subject to legal requirements and regulations. In some countries, there are laws that require companies to provide certain minimum levels of retrenchment compensation to employees who are being terminated due to restructuring or downsizing. These laws may also outline the process that companies must follow when retrenching employees, including giving advance notice and providing information about available assistance and support.

Retrenchment can be a difficult and stressful experience for employees, and the provision of retrenchment compensation can help to alleviate some of the financial burden and uncertainty that may arise during this transition period. It is important for employees to understand their rights and entitlements when it comes to retrenchment compensation, and to seek advice and assistance if they have any concerns or questions about this process.

How is retrenchment compensation calculated?

Take compensation package offered by company. If you have been denied gratuity payment by your employer, you can file a complaint under Section 8 of the act, against the company. Thank you very much! Can I refuse retrenchment? It tried to reduce office supplies use, deferred project implementation, froze hiring, and implemented a 5% cut in managerial salaries among others. Is it the correct compensation? So consult a local lawyer and then only take legal steps. The procedure of retrenchment has been given under Section 25G of the Industrial Disputes Act. Where the employee has been dismissed on account of his or her riotous, violent or disorderly conduct or for an offence involving moral turpitude committed in the course of employment, the gratuity shall be wholly or partly forfeited.

Is Retrenchment compensation an allowable deduction under Income Tax?

My question is can i resgn or ask company to terminate me? Employers are not precluded from retrenching employees during the national lockdown, provided the employer has a valid operational reason to implement retrenchments and follows the procedures set out in section 189 of the LRA. Also, they have to take prior approval of the Appropriate Government for retrenchment. The HR asked me to put down my papers and promised me three months of salary. The industry has been given proper consideration, and its success is linked to worker happiness. The 30-day notice is equally simple. How do you survive after retrenchment? Therefore you need to pay this. Any workman working in a firm for 240 days or more in the previous 12 months can in principle claim retrenchment compensation.

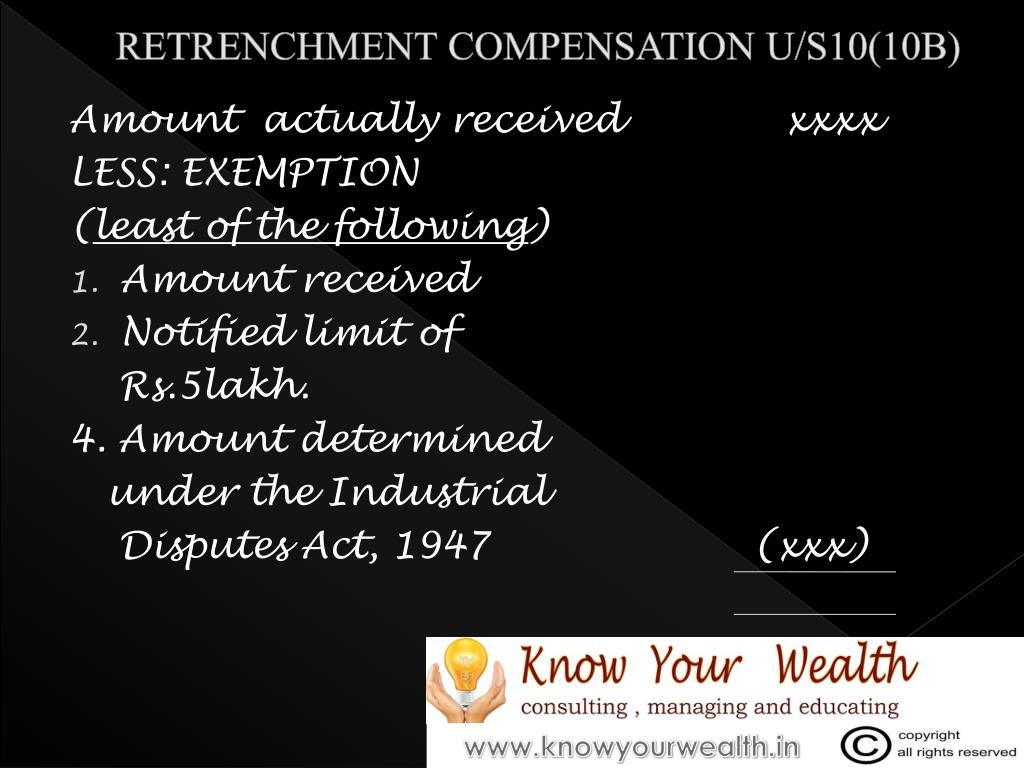

Exemption towards retrenchment compensation received by workman Section 10(10B)

.png?sfvrsn=b59a8206_3)

As per gratuity act employee who has completed contineous 5 years service is eligible to receive gratuity 15 days wages for per completed year of service. The highest amount that can be paid is 58% of what you earned per day. What is Section 10 13 A? An employer and his employee come into a relationship when the person signs an employment contract with the company. I have been the top performer and got the highest rating. How much will UIF pay me? Components of Calculation Retrenchment compensation calculation is calculated keeping in mind the allowances such as basic wages, dearness allowance DA , all attendance attendees, house rent allowance, conveyance etc. The sum of Rs.

Retrenchment Compensation

Do I have to pay tax on severance? Is anyone allowed to get retrenched? Meanwhile, some of the employees got job outside and joined them immediately. UIF can be claimed for 12 months, provided that you have full credit days. This is one of the authorized causes of termination of employment. Obligations and Duties of Employer in Retrenching Employees Maintenance of Muster Roll: The employer must keep and maintain a muster roll. She is a graduate of Bryn Mawr College A. CIT 1979 , where the main issue under consideration was whether the payments made by the assessee company to the employees and the director by way of compensation for termination of service were allowable as business expenditures under section 37 1 or not. Ask your employer if the company can pay you out over two years.

Retrenchment Compensation

How do you prove that he is employed in other company. It states that any amount received by an employee as a consequence of separation for any cause beyond the control of the employee is exempt from taxes regardless of age or length of service. As per the Sec. The employer pays the retrenched employees separation pay equivalent to one month pay or at least ½ month pay for every year of service, whichever is higher; 4. The Payment of Bonus Act 1948. Firstly send them a formal notice that you are entitled to compensation, bonus, PF's, FnF etc. The amount specified by the Central Government i.

.png?sfvrsn=b59a8206_3)