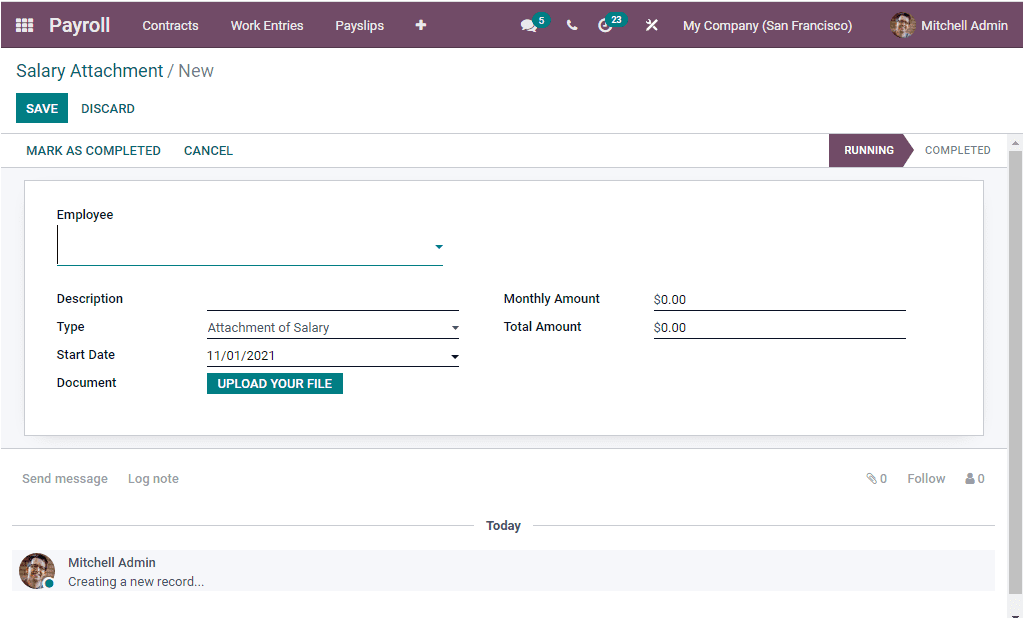

Attachment of salary refers to the legal process by which a portion of an individual's salary is seized or garnished in order to satisfy a debt or judgment. This can occur for a variety of reasons, such as failure to pay taxes, defaulting on a loan, or failing to pay court-ordered child support or alimony.

In the United States, the process of attachment of salary is governed by federal and state laws, as well as individual employer policies. Generally, an individual's wages can only be garnished if they have been properly served with a summons or court order. The amount of salary that can be garnished is also limited by law and varies by state.

One common type of salary attachment is a wage garnishment, which occurs when a creditor obtains a court order requiring an individual's employer to withhold a certain amount of their salary each pay period and send it directly to the creditor. This can be a stressful and embarrassing situation for the individual, as their financial situation becomes known to their employer and colleagues.

Another type of salary attachment is a levy, which is a legal seizure of an individual's assets, including their salary. A levy can be issued by the Internal Revenue Service (IRS) if an individual owes back taxes, or by a court if an individual has failed to pay a judgment or debt.

The process of attachment of salary can be complicated and can have significant financial consequences for the individual. It is important for individuals to understand their rights and obligations when it comes to paying debts and fulfilling court orders. If you are facing salary attachment or have questions about the process, it is advisable to seek the advice of a qualified attorney.

In conclusion, attachment of salary is a legal process that allows creditors or the government to seize a portion of an individual's salary in order to satisfy a debt or judgment. It is important for individuals to understand their rights and obligations in these situations and to seek legal advice if necessary.