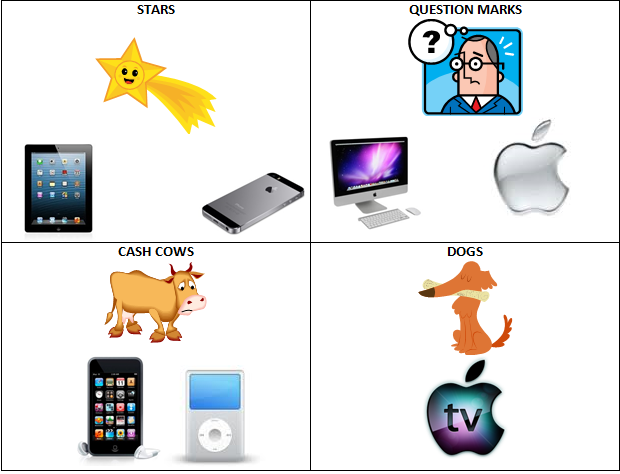

The BCG matrix, also known as the Boston Consulting Group matrix, is a tool used to analyze a company's product portfolio and assess the potential growth or decline of each product. It is based on the idea that a company's products can be classified as either high-growth or low-growth, and that the company should allocate resources accordingly.

In the case of Apple Inc., the BCG matrix can be used to analyze the company's various product lines and determine which products are likely to generate the most growth and profit in the future.

One of Apple's key high-growth products is the iPhone. The iPhone has consistently been one of the company's most successful products, with strong sales and high profit margins. As such, Apple should continue to allocate a significant amount of resources towards the development and marketing of the iPhone.

Another high-growth product for Apple is the iPad. The iPad has also seen strong sales and high profit margins, and Apple should continue to invest in this product line in order to maintain its position as a leader in the tablet market.

In addition to the iPhone and iPad, Apple's Mac line of computers and the Apple Watch have also been successful products with strong potential for growth. These products should also be considered high-growth and given appropriate resources for development and marketing.

On the other hand, Apple's iPod line has seen a decline in sales in recent years, and it may be considered a low-growth product. While the iPod may still generate some profit for the company, Apple should consider shifting resources away from this product line and towards its more successful products.

Overall, the BCG matrix can be a useful tool for Apple to analyze its product portfolio and make informed decisions about where to allocate resources in order to drive growth and maximize profits. By focusing on its high-growth products and investing in their development and marketing, Apple can continue to be a leader in the tech industry.