Profit and wealth maximization are two common goals that businesses and individuals may pursue, but they are not the same thing. Understanding the difference between these two concepts can help you make better financial decisions and achieve your financial objectives more effectively.

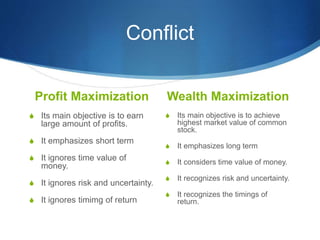

Profit maximization refers to the process of maximizing the amount of profit that a business or individual generates. Profit is the difference between a company's revenue and its expenses, and it is typically measured in monetary terms. Businesses may seek to maximize their profits in order to improve their financial performance and attract investors.

On the other hand, wealth maximization refers to the process of maximizing an individual's or a business's overall wealth, which includes both financial assets and non-financial assets such as real estate and intellectual property. Wealth maximization may involve a variety of strategies, such as investing in a diverse range of assets, minimizing taxes, and minimizing risks.

There are some important differences between profit maximization and wealth maximization. For one thing, profit maximization is typically focused on short-term results, while wealth maximization is more concerned with long-term financial goals. Profit maximization may also involve taking risks or engaging in activities that may not be sustainable in the long run, while wealth maximization tends to be more focused on long-term stability and sustainability.

Another key difference between profit maximization and wealth maximization is that profit maximization is often focused on the financial performance of a single business, while wealth maximization may involve a wide range of financial and non-financial assets. For example, an individual may seek to maximize their wealth by investing in a diverse portfolio of stocks, real estate, and other assets, rather than just focusing on the profits of a single business.

Ultimately, the choice between profit maximization and wealth maximization will depend on your financial goals and priorities. Some individuals and businesses may prioritize short-term profits, while others may be more focused on building long-term wealth. It is important to carefully consider your financial objectives and the potential risks and benefits of different strategies in order to make informed financial decisions.