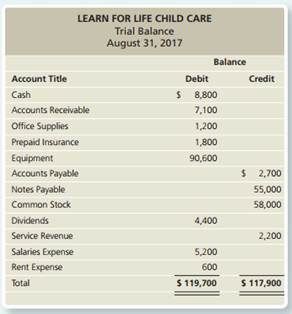

A trial balance is a tool used in accounting to ensure the accuracy of a company's financial records. It is a listing of all the company's accounts and their balances, and it is used to verify that the total debits equal the total credits. If the trial balance does not balance, it is an indication that there is an error in the financial records.

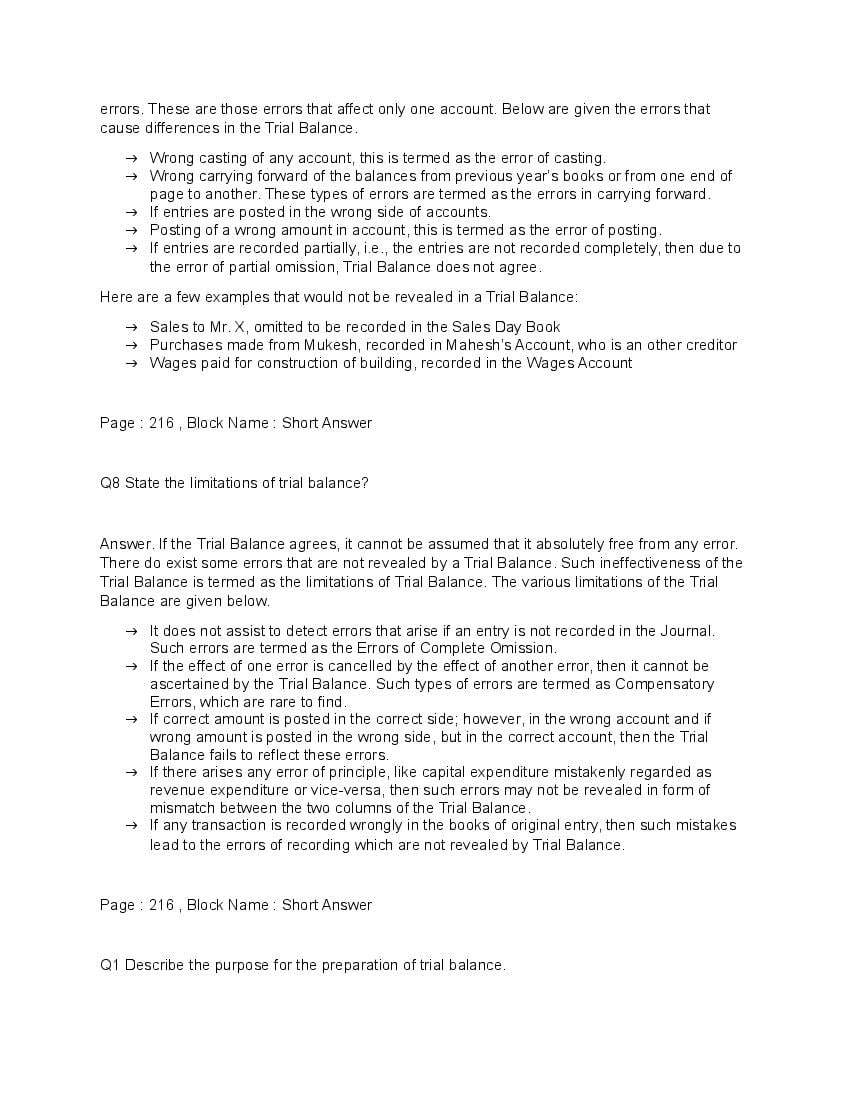

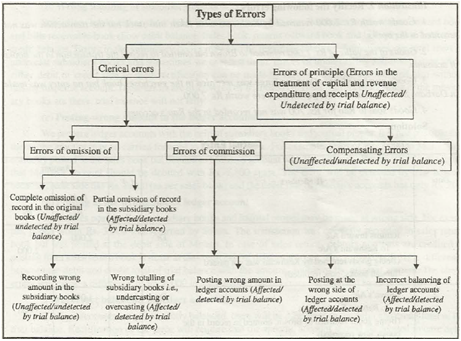

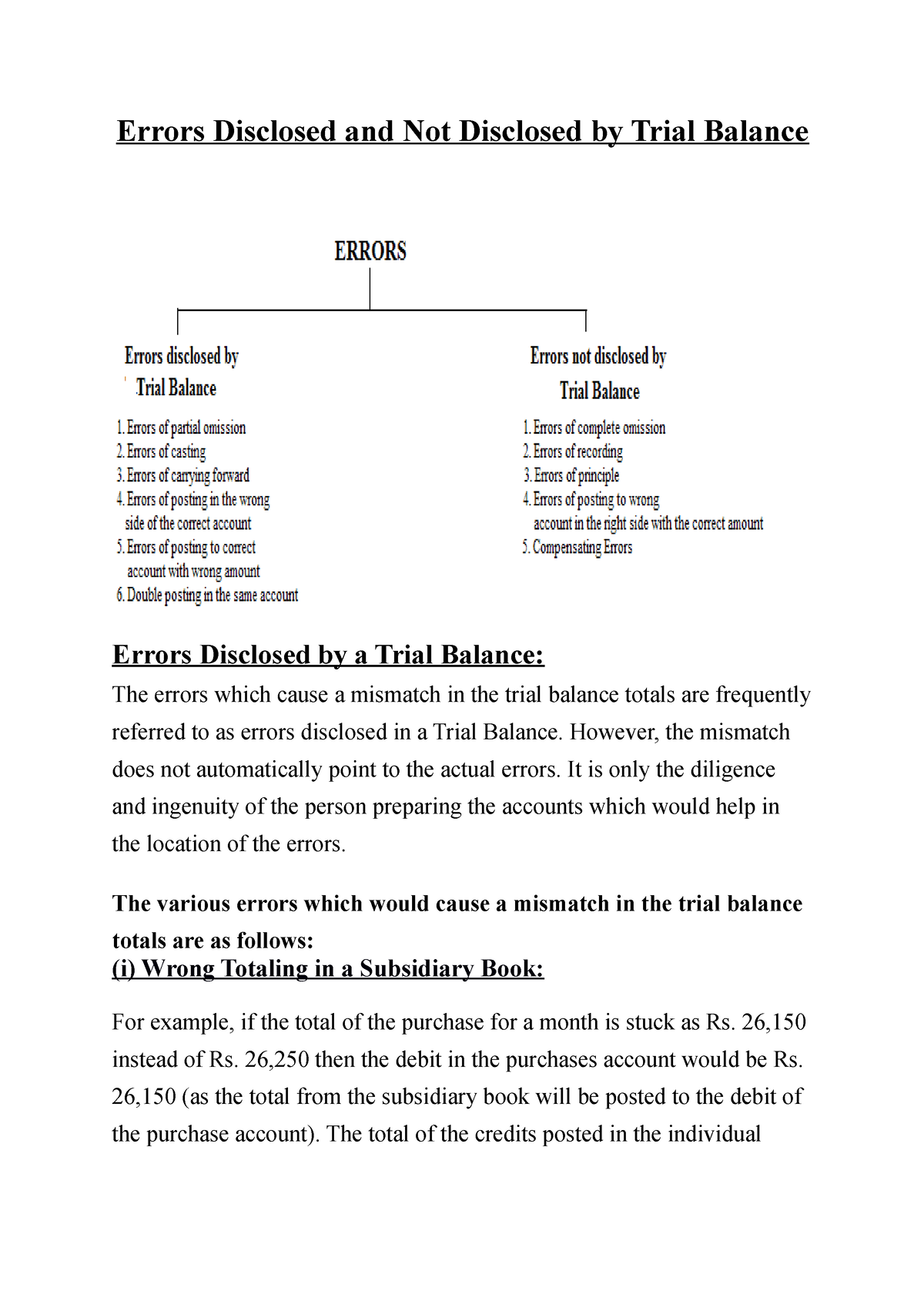

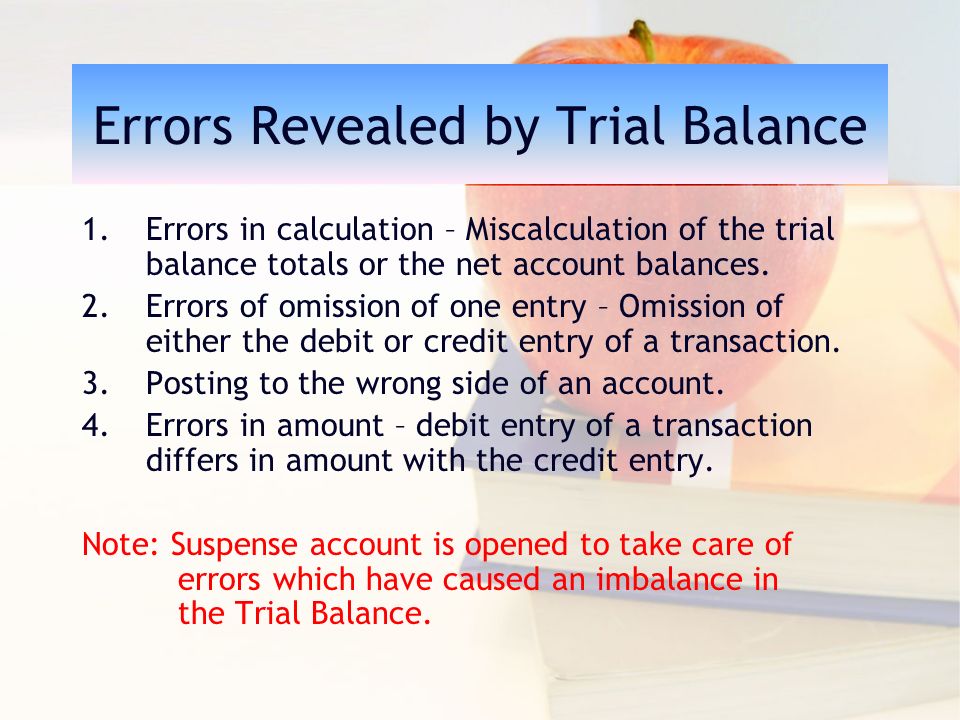

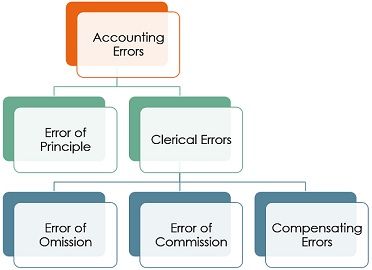

There are several types of errors that can be detected by a trial balance. One common error is an incorrect posting of transactions. This can occur when a transaction is recorded in the wrong account or when the amount of the transaction is incorrect. For example, if a company pays $500 for rent, but the transaction is recorded as $50, the trial balance will not balance.

Another type of error that can be detected by a trial balance is a transposition error. This occurs when a transaction is recorded correctly, but the amounts are recorded in the wrong columns. For example, if a company receives $500 in revenue, but the transaction is recorded as a credit instead of a debit, the trial balance will not balance.

A third type of error that can be detected by a trial balance is a missing transaction. This occurs when a transaction is not recorded at all. For example, if a company pays $500 in rent, but the transaction is not recorded in the company's financial records, the trial balance will not balance.

Errors can also be detected by a trial balance if there are differences in the way accounts are classified. For example, if a company has two accounts for office supplies, but one is classified as a current asset and the other is classified as a long-term asset, the trial balance will not balance.

Finally, errors can also be detected by a trial balance if there are errors in the calculations used to prepare the financial statements. For example, if the company's balance sheet is prepared using incorrect values for assets and liabilities, the trial balance will not balance.

In conclusion, a trial balance is a valuable tool in ensuring the accuracy of a company's financial records. It can detect several types of errors, including incorrect postings, transposition errors, missing transactions, differences in account classification, and errors in calculations. By regularly performing a trial balance, a company can ensure that its financial records are accurate and reliable.