An IDBI Bank statement is a document that provides a detailed record of a customer's financial transactions with the bank over a specified period of time. It typically includes information about deposits, withdrawals, fees, and any interest earned or charged. IDBI Bank is a government-owned financial institution in India that offers a range of banking and financial services to individuals, businesses, and corporations.

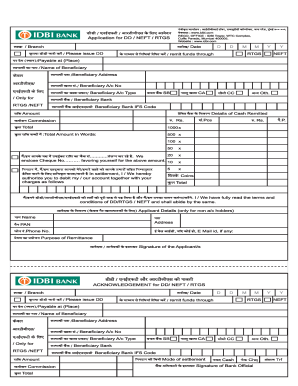

To obtain a sample IDBI Bank statement, a customer can log into their online banking account or visit a local branch and request a copy. The statement can be provided in physical or electronic form, depending on the customer's preference.

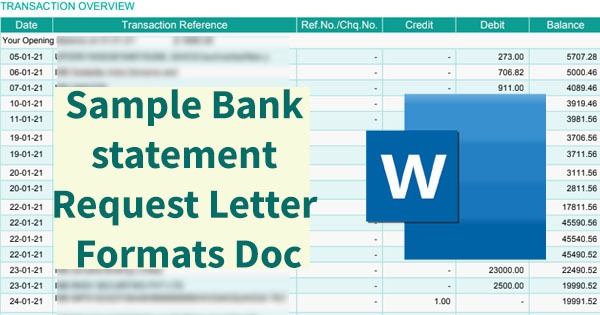

The statement typically begins with the customer's personal and account information, including their name, account number, and the period covered by the statement. It will then list all of the transactions that occurred during that time period, including the date, type of transaction (such as a deposit or withdrawal), and the amount involved.

In addition to individual transactions, the statement may also include a summary of the account's current balance, any fees that have been charged, and any interest earned or paid. It may also include information about any outstanding loans or credit card balances and their current status.

IDBI Bank statements are an important tool for customers to track and manage their financial affairs. They provide a comprehensive overview of a customer's financial activity and can help them make informed decisions about their money. By regularly reviewing their statements, customers can identify any unusual activity or discrepancies and address them promptly to avoid potential problems.

In conclusion, an IDBI Bank statement is a valuable resource for customers to understand and manage their financial accounts. It provides a detailed record of all transactions and can help customers stay on top of their financial situation and make informed decisions about their money.

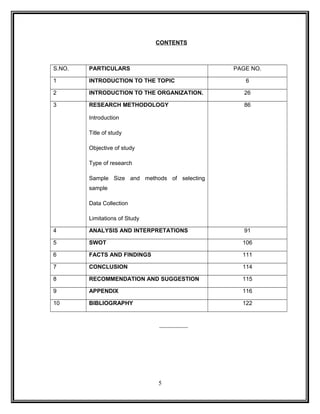

IDBI Bank Balance Sheet, IDBI Bank Financial Statement & Accounts

It is possible to check the last 5 transactions on the mini statement. Ask a member of the bank staff for more details about this. What is the maximum loan term which you can access while availing home loan from IDBI? The statement records all your checks, deposits, and interest payments, if any, for that time period and is usually sent out 12 times in a year. However, banks are required by law to hold onto your bank statements for up to 5 years. The second step is the bank printing that information either by category or in chronological order. Once you receive the statement, you are to get your checkbook and compare records.

50+ SAMPLE Bank Statements in PDF

InvestPlus is changing the way you manage your. Hackers love to get unprotected bank statements as they get your SSI number, your address, your bank account number, and so on. In India, almost 2000 branches of the bank run to provide service and there are over 3800 ATMs. FAQs What is a bank reconciliation? You can easily access it through your computer, phones, and other devices by visiting their website or simply installing their app to your device. It also helps you identify suspicious activity as well as reminds you to watch your spending habits.

Process to view and download IDBI Bank home loan statement online and offline

It is best to send or give hard copies of your statement to legitimate businesses that have the right to that information. Save your time and just download our professionally made template, which may be the best for your online account verification, research, presentation, or work. Therefore, having the power to check your bank statement anytime you need to is very important. An APY is a percentage that you earned for that specific period based on the annual percentage that you should earn and its compounding. A: Currently, account holders can download IDBI mPassbook app from Google Play Store or Apple App Store. How can I get a mini statement of IDBI online? You should take note, however, that according to Step 3: Sign up for Online Banking Now that you know the mediums that you can use to get a copy of your bank statement, you can already decide which way you want to receive your statement. This banking template is editable sample of India IDBI bank statement in doc format.

16 Editable Bank Statement Templates and Examples

Here you can Contact IDBI customer carefor more detail. How much home loan can I get with a salary of 20,000?. We designed a template for people who do not have Photoshop or design skills, but need the template for their work, research, presentation, media or something else. If you are not sure how to request a statement via the internet, ask your bank for help. IDBI Bank mPassbook App This is a mobile passbook that is provided to every account holder at IDBI Bank.

Personal & Corporate Banking

You can give a missed call to 1800-843-1133 from your registered mobile number and post that, you will receive an SMS with the details of your last transactions at IDBI Bank. For the bank statement, the bank sets the time frame at 30 days, usually. They may also occasionally issue this type of document to incorporate notices, such as changes in fees and interest rates, and promotional materials. Thus, calling them or visiting them may be a better option. However, when it comes to legal matters, these records may matter just a little.