Break-even analysis is a financial tool that is commonly used by businesses to determine the point at which their revenues and costs are equal, also known as the break-even point. At this point, the business is neither making a profit nor incurring a loss. Break-even analysis can be a useful tool for decision making, as it allows businesses to evaluate the potential profitability of different options and make informed decisions about which course of action to take.

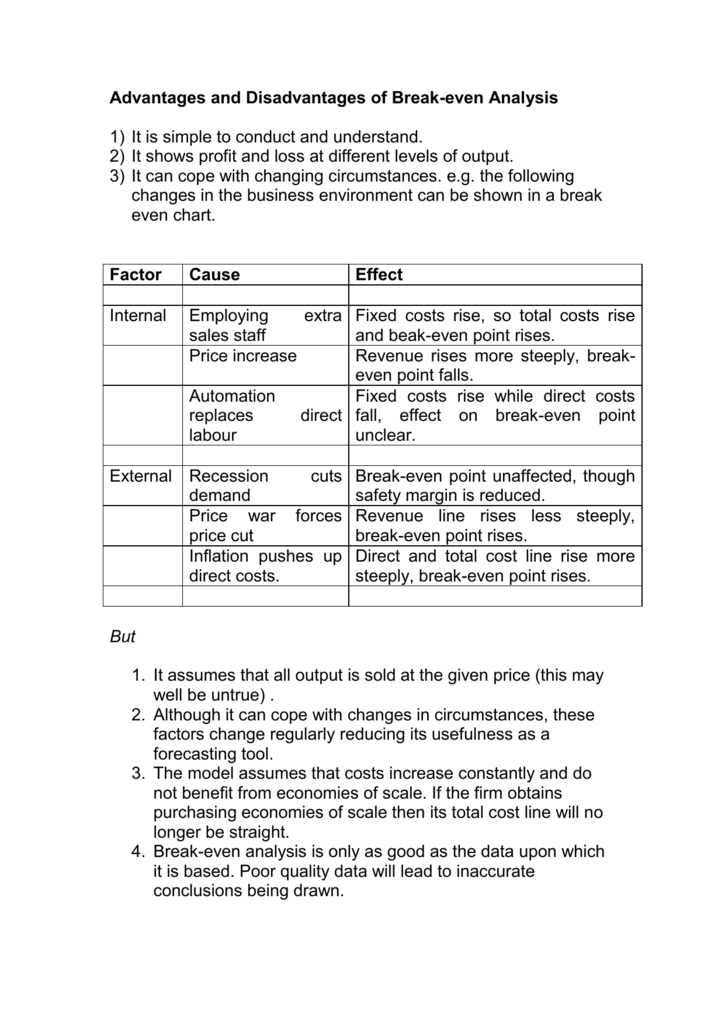

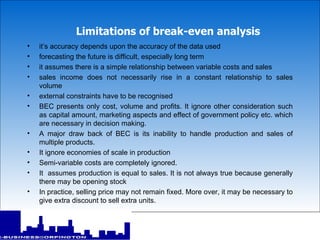

However, there are several limitations of break-even analysis that should be considered when using it for decision making. One of the main limitations is that it is based on a number of assumptions, which may not always hold true in practice. For example, break-even analysis assumes that the business will be able to sell all of its products or services at the price that has been calculated, which may not be possible if market conditions change or competition increases.

Another limitation of break-even analysis is that it does not take into account the time value of money. This means that it does not consider the fact that money is worth more in the present than in the future. This can be a significant limitation, particularly for businesses that are planning for the long term, as the value of money can change significantly over time.

Break-even analysis also does not take into account the risk associated with different options. This means that it does not consider the potential for unexpected events or changes in the market, which could have a significant impact on the profitability of a business.

Finally, break-even analysis can be limited by the accuracy of the data that is used to create the model. If the data is not accurate or is not representative of the business's actual operating conditions, the results of the break-even analysis may not be reliable.

In conclusion, while break-even analysis can be a useful tool for decision making, it is important to recognize its limitations and consider other factors, such as market conditions, the time value of money, and risk, when making decisions. By taking these limitations into account, businesses can make more informed and reliable decisions about their operations and strategy.