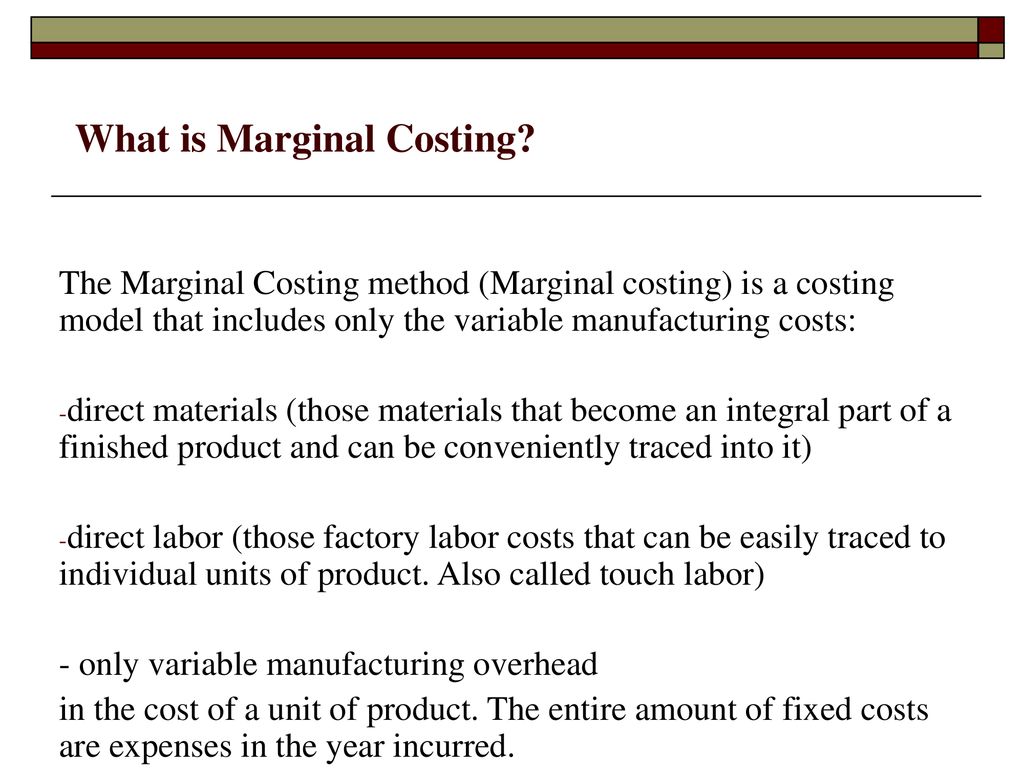

The marginal costing method, also known as variable costing, is a managerial accounting technique that focuses on the behavior of a company's costs as output changes. It is a useful tool for decision-making, as it helps managers understand the cost implications of their decisions and allocate resources efficiently.

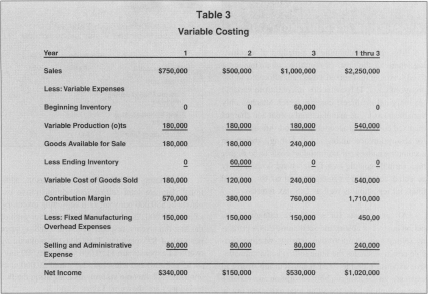

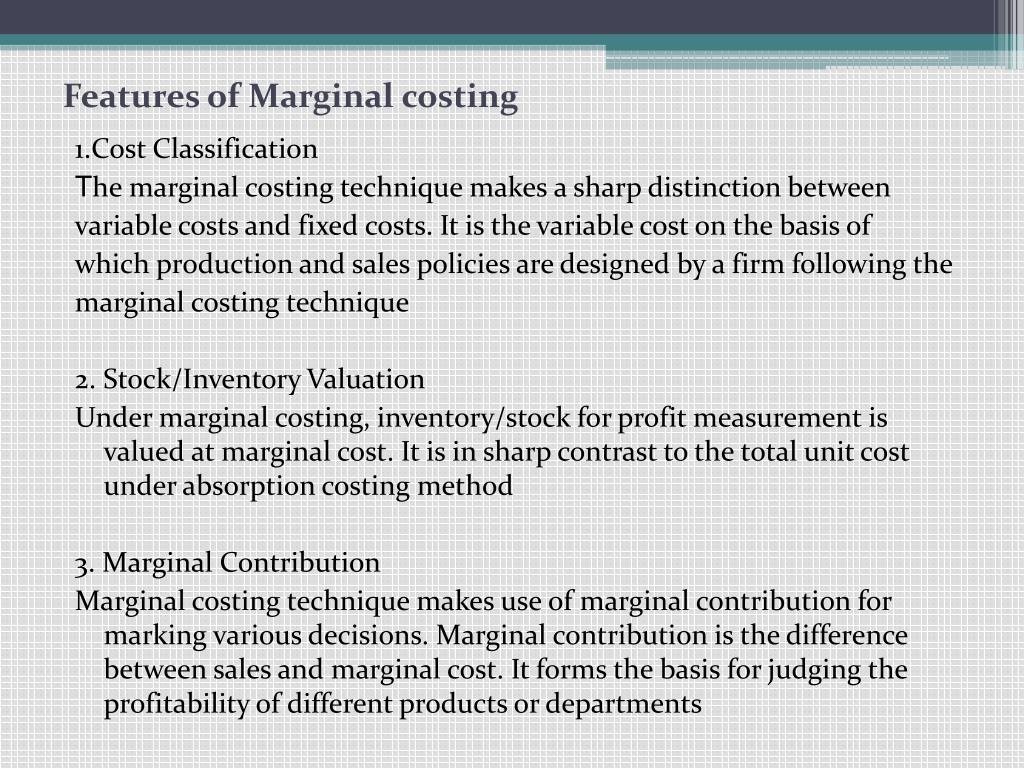

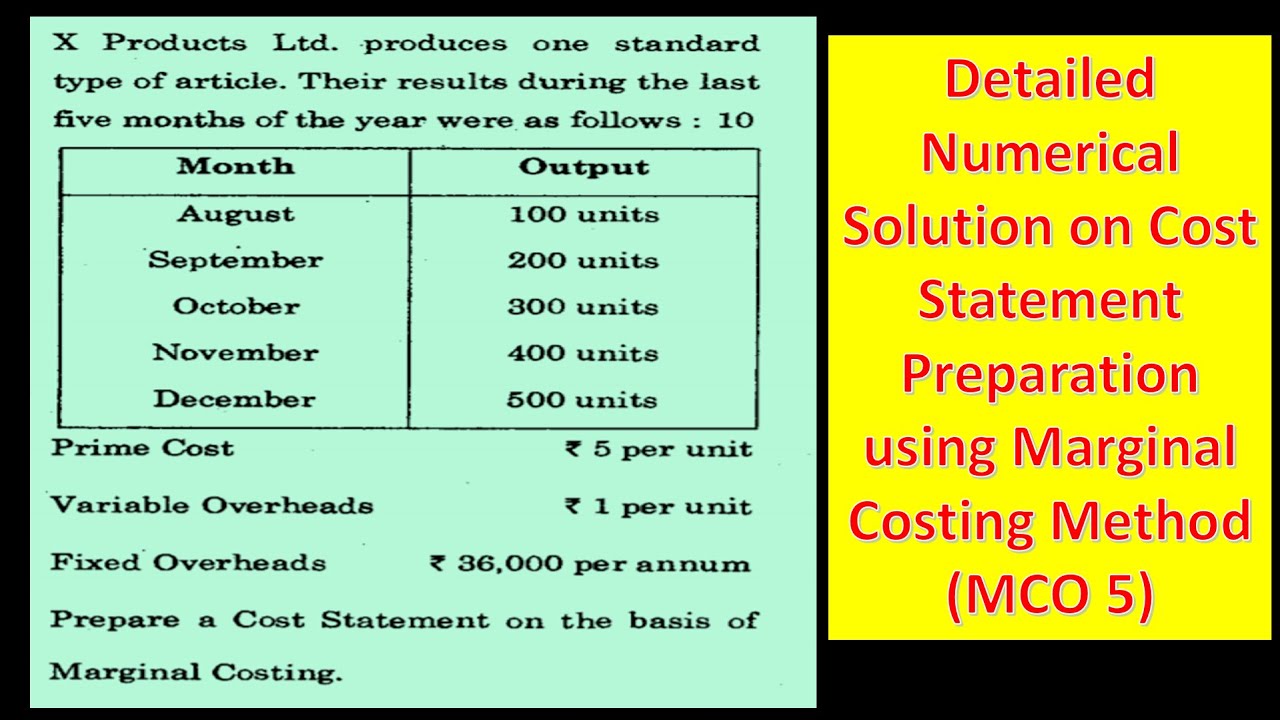

In the marginal costing method, only variable costs are included in the cost of goods sold. Fixed costs, such as rent and salaries, are not included in the calculation of the cost of goods sold and are treated as a separate expense. This approach allows managers to focus on the incremental costs associated with changes in output, rather than the overall costs of producing a product or service.

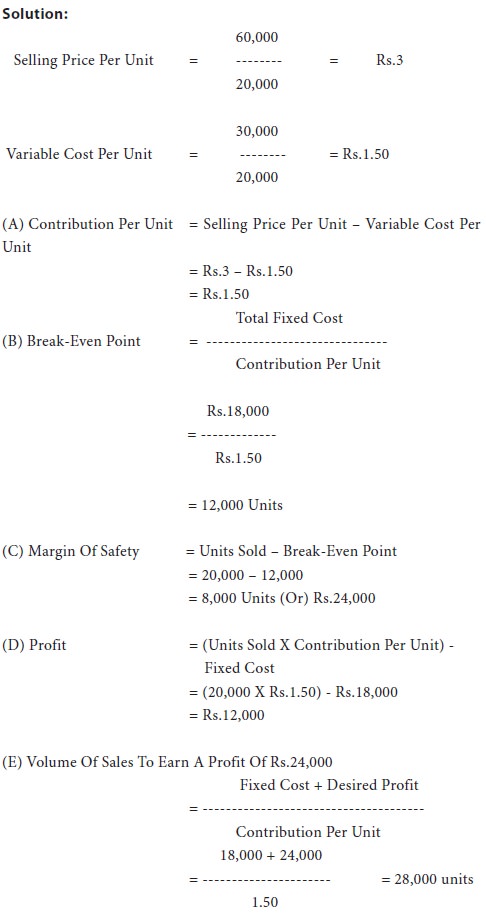

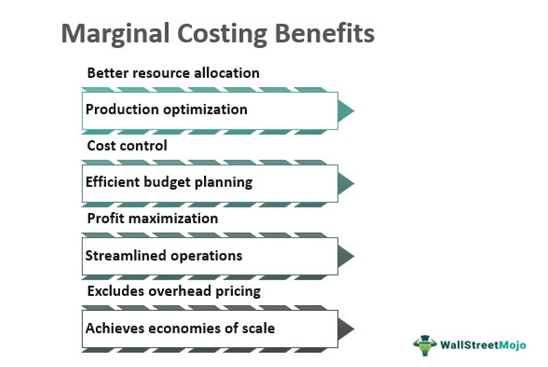

One advantage of the marginal costing method is that it provides a more accurate picture of the cost of producing each unit of output. By only including variable costs, the marginal costing method reflects the fact that certain costs, such as labor and materials, vary directly with the level of output. This allows managers to make better informed decisions about pricing, as they can see the direct cost impact of producing each additional unit.

Another advantage of the marginal costing method is that it helps managers identify opportunities for cost savings. By separating fixed costs from variable costs, managers can see where they can make changes to reduce costs without affecting the overall production process. For example, if a company is able to negotiate lower prices for raw materials, this will directly impact the variable cost of producing each unit and can lead to increased profitability.

However, it is important to note that the marginal costing method has some limitations. One of the main limitations is that it does not consider the impact of fixed costs on profitability. Fixed costs are not included in the calculation of the cost of goods sold, so they do not directly impact the profit or loss for each unit of output. This means that a company may appear more profitable using the marginal costing method, even if it is not generating enough revenue to cover its fixed costs.

Overall, the marginal costing method is a useful tool for decision-making and resource allocation, but it should be used in conjunction with other accounting techniques to provide a complete picture of a company's financial performance.