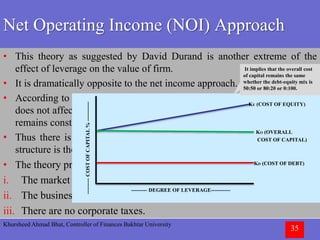

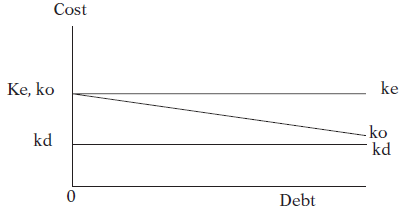

The net operating income approach to capital structure, also known as the net income approach or the earnings approach, is a method used to determine the optimal mix of debt and equity financing for a company. This approach is based on the idea that the value of a company is determined by its ability to generate income, and therefore the optimal capital structure should be the one that maximizes the company's net operating income.

To determine the optimal capital structure using the net operating income approach, a company must first calculate its net operating income. This is done by subtracting the company's operating expenses from its operating revenues. The net operating income represents the income that is available to be distributed to shareholders or used to pay down debt.

Once the net operating income has been calculated, the company can then determine the optimal capital structure by comparing the net operating income at different levels of debt and equity financing. For example, if the net operating income is higher when the company has a higher level of debt financing, then this may be the optimal capital structure. On the other hand, if the net operating income is higher when the company has a higher level of equity financing, then this may be the optimal capital structure.

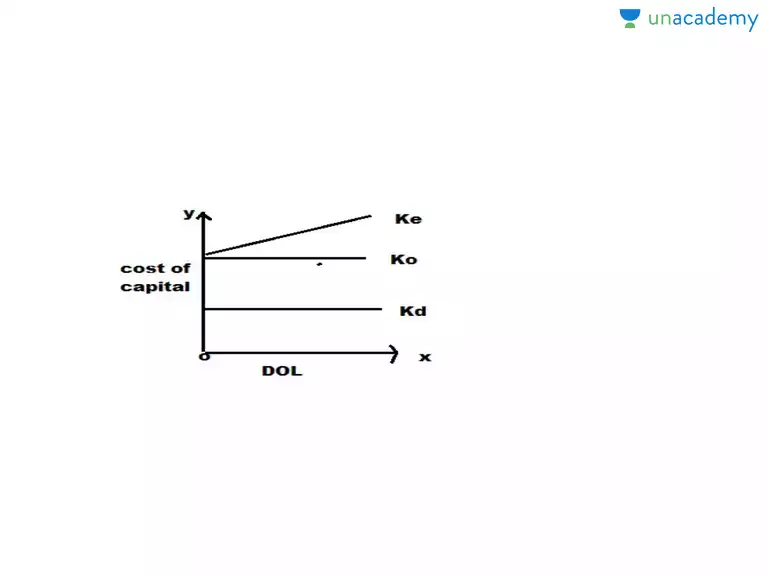

There are several factors that can impact the net operating income and the optimal capital structure, including the company's tax rate, the cost of debt, and the level of risk associated with the company's operations. The net operating income approach takes these factors into account in order to determine the optimal capital structure for the company.

One of the main advantages of the net operating income approach to capital structure is that it is based on the company's ability to generate income, which is a key determinant of value. This means that the optimal capital structure determined using this approach is likely to be the one that maximizes the value of the company. Additionally, the net operating income approach takes into account the specific circumstances of the company, including its tax rate, the cost of debt, and the level of risk associated with its operations, which makes it a more accurate and relevant approach compared to other methods that do not consider these factors.

In conclusion, the net operating income approach to capital structure is a method used to determine the optimal mix of debt and equity financing for a company. This approach is based on the idea that the value of a company is determined by its ability to generate income, and therefore the optimal capital structure should be the one that maximizes the company's net operating income. The net operating income approach takes into account the specific circumstances of the company and is a more accurate and relevant approach compared to other methods that do not consider these factors.