In William Shakespeare's play "Hamlet," the ghost of the late King Hamlet appears to the main character, Prince Hamlet, and tells him that he was murdered by his own brother, Claudius, who has since taken the throne and married Hamlet's mother, Queen Gertrude. The ghost urges Hamlet to seek revenge for his murder, and this desire for revenge drives much of the action in the play.

The ghost is a central figure in "Hamlet," and his appearance and the revelations he makes have a profound impact on the characters and the plot. Some scholars have argued that the ghost is a manifestation of Hamlet's own subconscious, representing his inner turmoil and desire for revenge. Others have suggested that the ghost may be a manifestation of Hamlet's guilt, as he feels responsible for his father's death due to his inaction and indecision.

There is also debate over whether the ghost is actually the spirit of King Hamlet or some other supernatural being, such as a devil or an angel. Some scholars have argued that the ghost is a malevolent spirit, seeking to lead Hamlet down a path of destruction and further inciting the cycle of violence and revenge in the play. Others have suggested that the ghost is a benevolent spirit, guiding Hamlet towards a righteous path of justice and helping him to uncover the truth about his father's murder.

Ultimately, the identity and nature of the ghost in "Hamlet" remains open to interpretation, and different readings of the play can offer different insights into this mysterious and enigmatic character. Regardless of its true nature, however, the ghost plays a crucial role in the play, influencing the actions and motivations of the characters and driving the tragic events that unfold.

subsidiary conclusion : LSAT

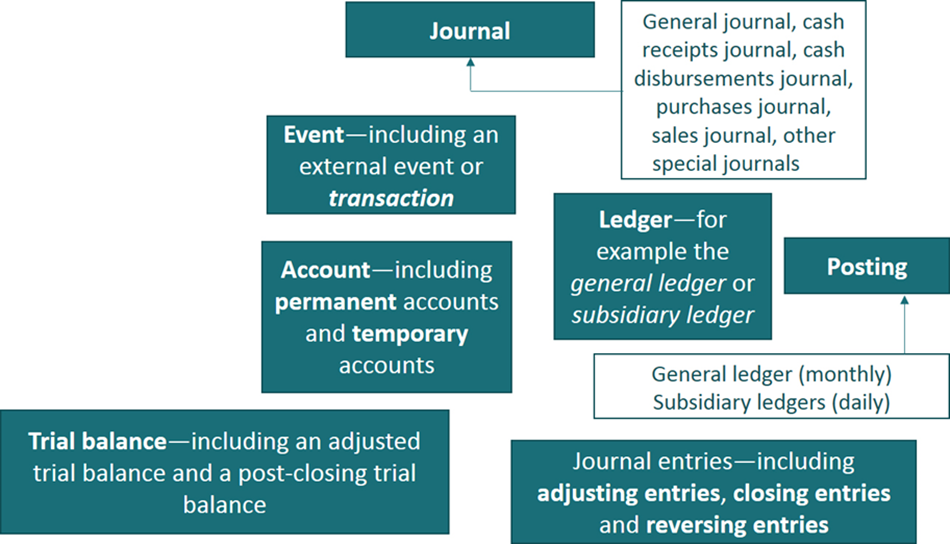

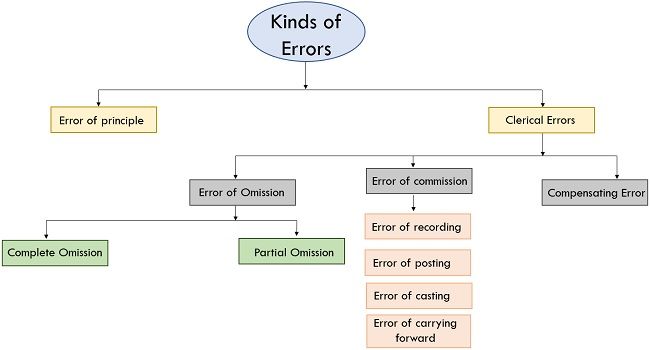

In this article, we will see different types of Subsidiary Books. It is very difficult to teach more students in a personal touch. Therefore,immediate steps should be taken to determine the safety of these chemicals. Petty cash book: A petty cash book is used to record all cash payments of smaller demoniations. The majority of transactions in the normal course of business involve either sales, purchases, cash etc. They are: Single Column Cash Book: A single column cash book is like a ledger account. Any economic transaction or event of a business, which can be expressed in monetary terms, should be recorded.

What is the Significance of Subsidiary Books

While the triple column cash book consists of cash, Some organizations also maintain a petty cash book which records the petty or small cash expenses of the firm. Classifying Accounting is the art of classifying business transactions. Subsidiary books help in categorising different heads into different categories where they belong, this makes it easier to identify the transactions and do accounts properly. If they had shareholders then accounts would be used to record their assets and liabilities and pay them out on their behalf. When number of transactions are large, it is practically impossible to record all the transactions through one journal, the journal is subdivided in such a way that a separate book is used for each category of transactions which are repetitive in nature and are sufficiently large in number. Journal proper is a book of original entry, this is known as the journal also. We record the transactions chronologically to facilitate the accountant.

What are Subsidiary Books?

The information in these books is later summarized and posted into a general ledger, from this the financial statements are produced. And these books record the details of the transactions and therefore help the ledger to become brief. Cash Journal a Single column cash book Cash transactions b Double column cash book Cash and discount transactions c Triple column cash book Cash, bank and discount transactions d Petty cash book Petty cash transactions II. These may be classified into tangible real account and intangible real account. Normally, the following subsidiary books are used in a business: i Cash book to record receipts and payments of cash, including receipts into and payments out of the bank.