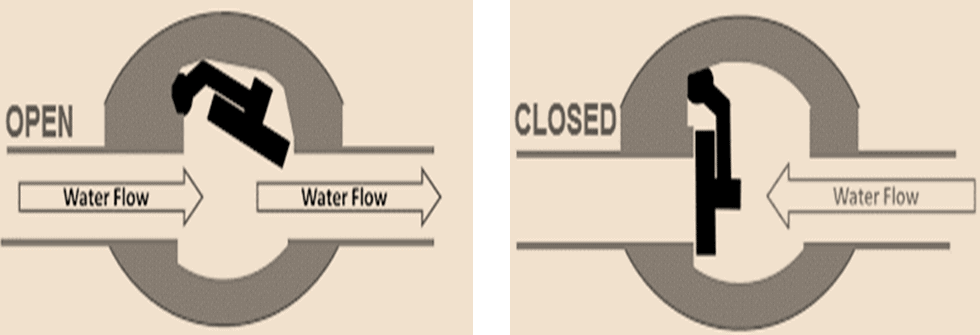

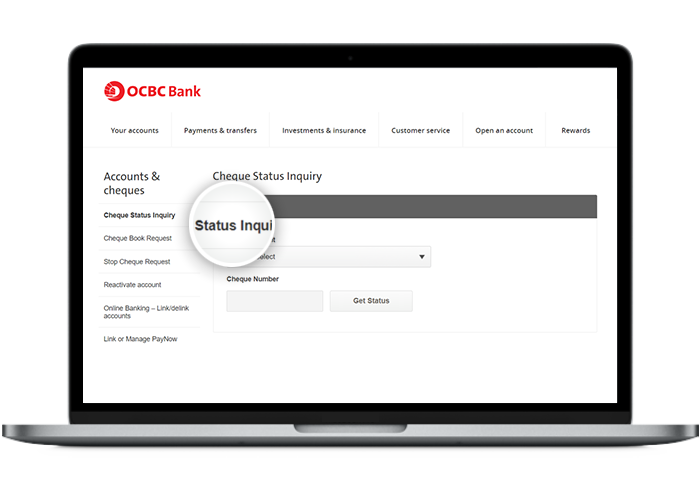

An open check is a type of check that has not been filled in with the payee's name or the amount to be paid. Instead, the payee's name and the amount to be paid are left blank, and the check can be filled in by the person who receives it. Open checks are often used as a way to give someone else the authority to write a check on behalf of the issuer, or to pay someone an unspecified amount of money at a later date.

Open checks are typically issued by businesses or organizations, and they are often used as a way to pay employees or contractors. For example, a business might issue an open check to an employee as a way to reimburse them for expenses that they have incurred on behalf of the company. The employee can then fill in the check with the name of the payee and the amount to be paid, and submit it for payment.

Open checks can also be used as a form of payment for goods or services. For example, a customer might receive an open check from a business as a way to pay for a product or service that they have received. The customer can then fill in the check with the name of the payee and the amount to be paid, and submit it for payment.

One of the main advantages of open checks is that they give the recipient the flexibility to determine the amount to be paid and the payee's name. This can be particularly useful in situations where the exact amount to be paid is not known at the time the check is issued, or where the payee's name is not known.

However, open checks also come with some risks. Because the payee's name and the amount to be paid are not filled in at the time the check is issued, there is a risk that the check could be altered or forged. This is why it is important for businesses and organizations to carefully control the issuance and use of open checks, and to have safeguards in place to prevent fraud and abuse.

In summary, an open check is a type of check that is issued with the payee's name and the amount to be paid left blank. It is often used as a way to give someone else the authority to write a check on behalf of the issuer, or to pay someone an unspecified amount of money at a later date. While open checks offer some flexibility and convenience, they also come with some risks, and it is important to carefully manage their use to prevent fraud and abuse.