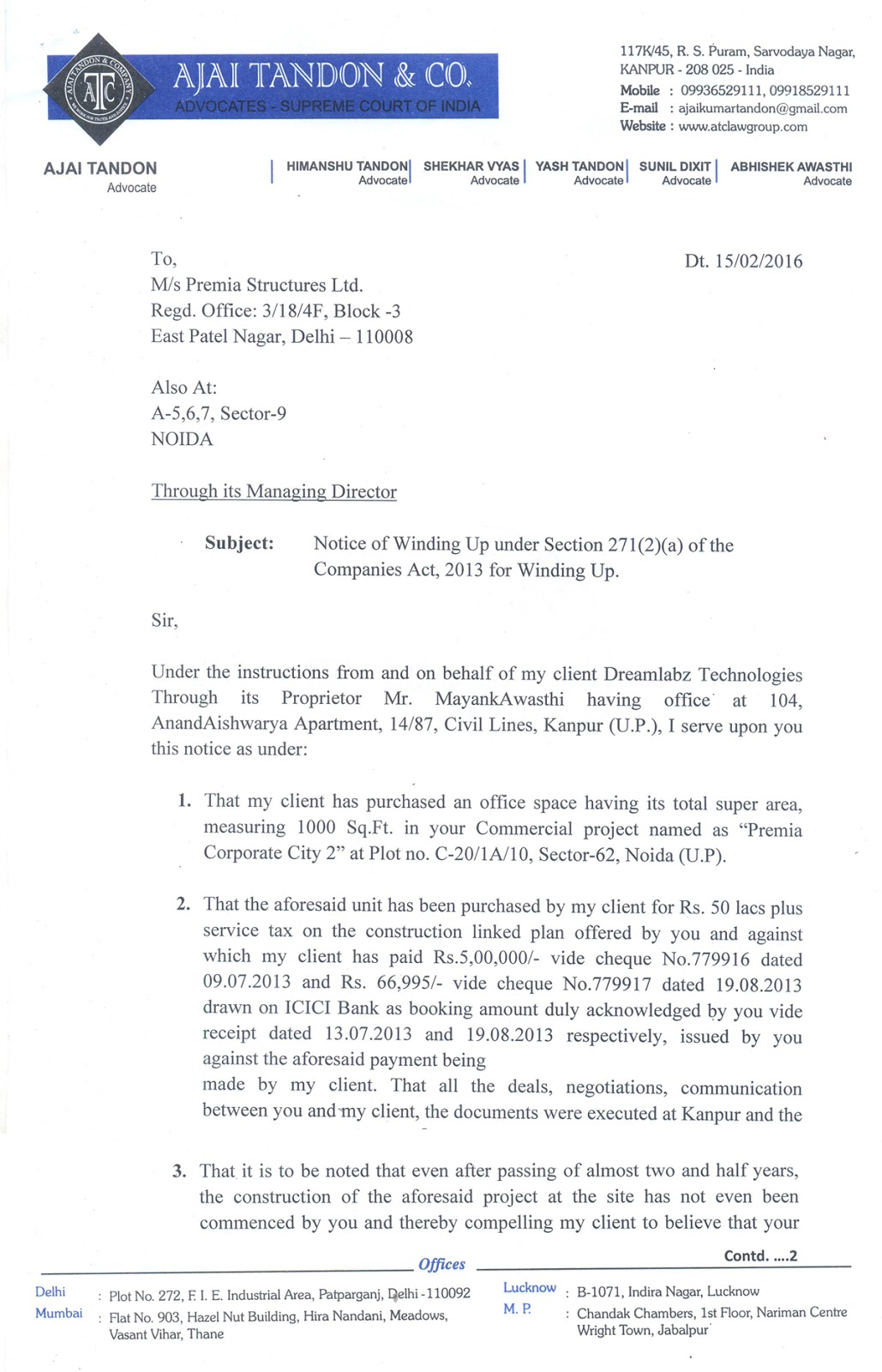

A winding up notice is a legal document that is issued to a company when it is unable to pay its debts. This notice is usually issued by a creditor who is seeking to recover the money that is owed to them by the company. It is a serious matter for a company to receive a winding up notice, as it can lead to the dissolution of the company and the liquidation of its assets.

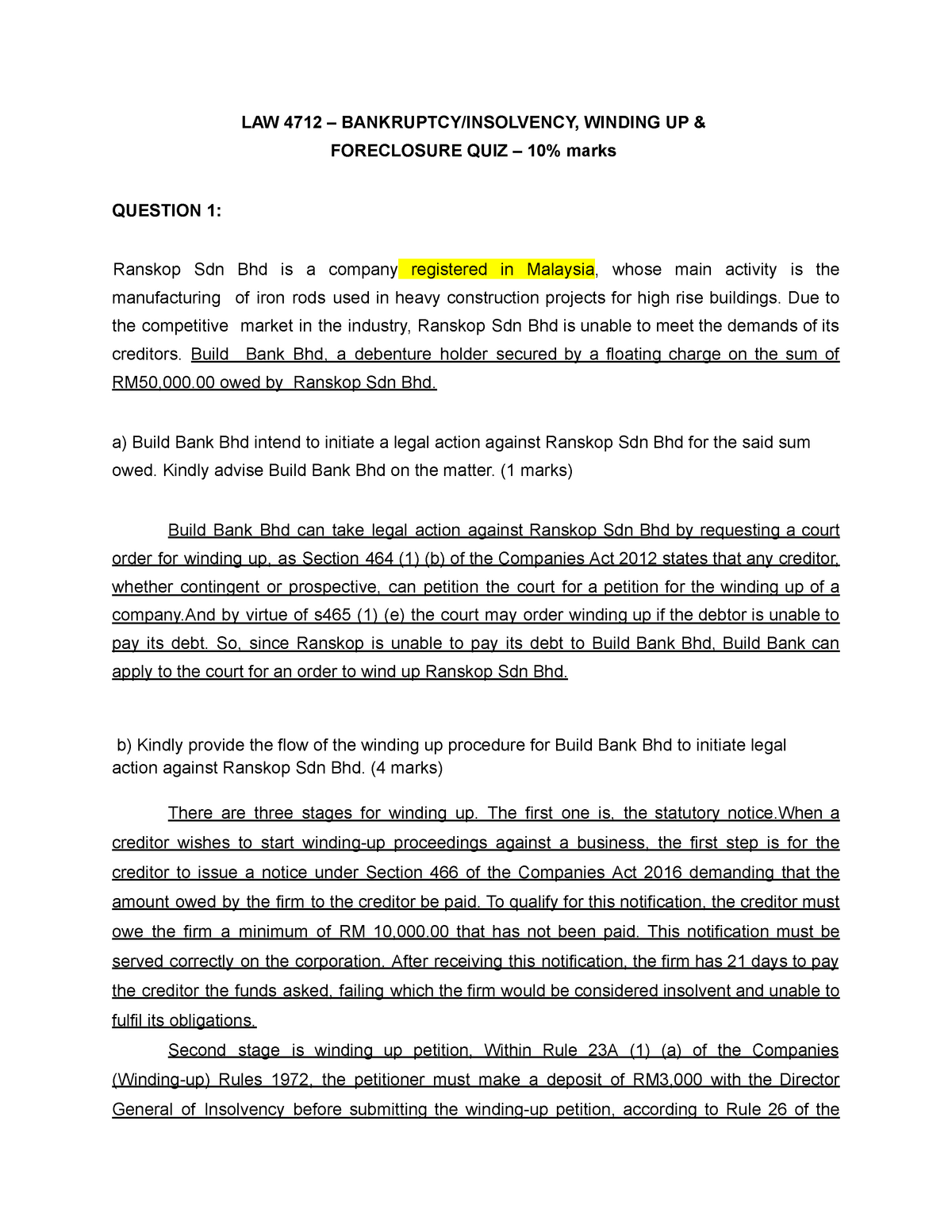

There are several reasons why a company might receive a winding up notice. One of the most common reasons is that the company has failed to pay its debts on time. This could be because the company has experienced financial difficulties, or because it has mismanaged its finances. In either case, the creditor has the right to seek recovery of the debt through legal means, including the issuance of a winding up notice.

Another reason why a company might receive a winding up notice is that it has become insolvent. Insolvency is defined as the inability of a company to pay its debts as they become due. This could be due to a variety of factors, including poor management, economic downturn, or competition from other businesses. In these cases, the creditor may seek to recover the debt through the winding up of the company.

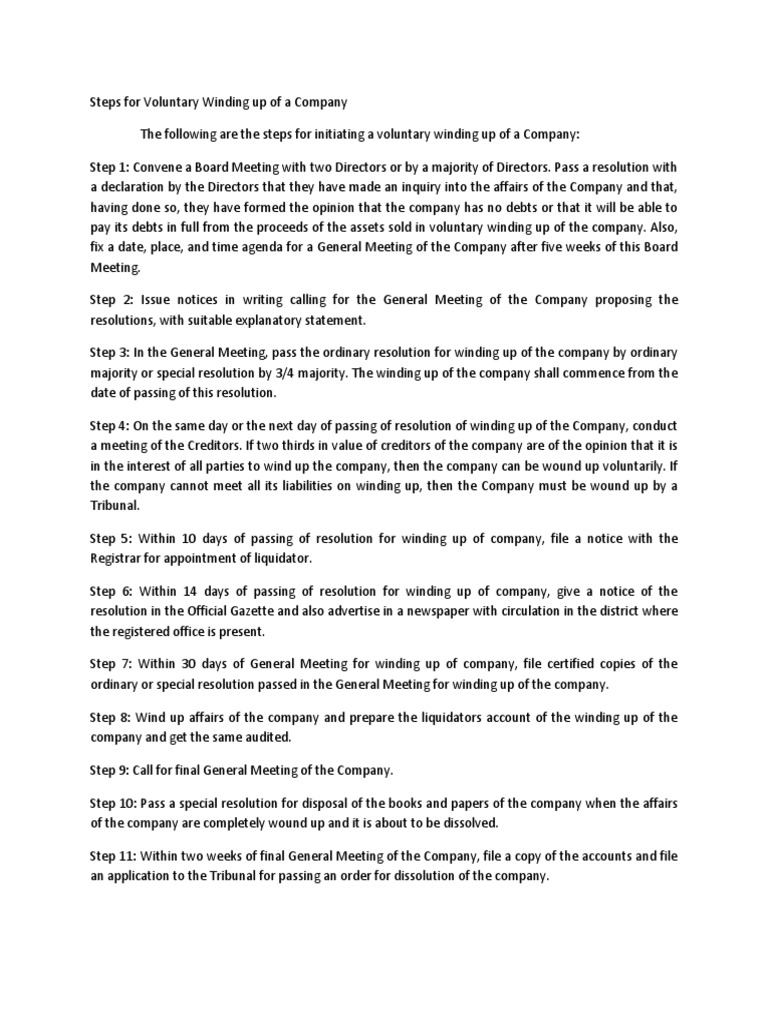

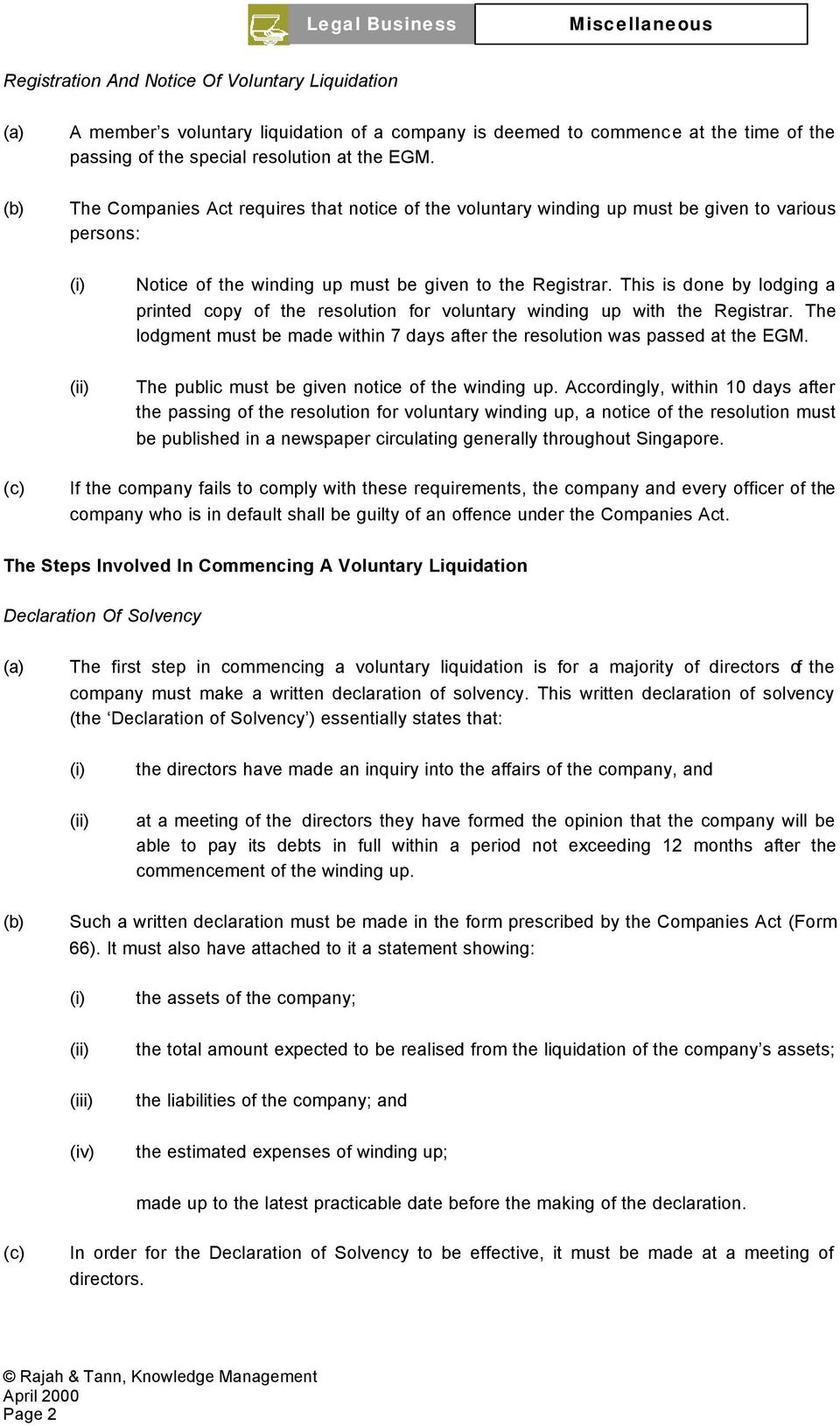

There are several consequences of receiving a winding up notice. One of the most significant is that it can lead to the dissolution of the company. This means that the company will no longer be able to carry out its business activities, and its assets will be sold off in order to pay its debts. This can have serious implications for the company's shareholders, employees, and creditors, as they may lose their investments, jobs, and the chance to recover their debts.

In order to avoid receiving a winding up notice, it is important for companies to manage their finances carefully and pay their debts on time. This may require seeking outside help, such as financial advice or restructuring assistance, in order to get back on track. It is also important for companies to communicate with their creditors and try to come to a resolution before the creditor takes legal action.

In conclusion, a winding up notice is a serious matter for a company, as it can lead to the dissolution of the company and the liquidation of its assets. It is important for companies to manage their finances carefully and pay their debts on time in order to avoid receiving a winding up notice. By doing so, they can protect the interests of their shareholders, employees, and creditors and ensure the long-term success of their business.