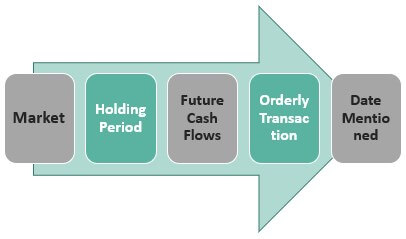

Current value accounting, also known as fair value accounting, is a method of accounting that values assets and liabilities on the balance sheet at their current market value, rather than their historical cost. This approach is based on the idea that the value of an asset or liability can change over time due to changes in market conditions, and therefore should be reflected in the financial statements.

One advantage of current value accounting is that it provides a more accurate representation of an organization's financial position. By using current market values, current value accounting takes into account changes in the value of assets and liabilities, which can provide a more realistic picture of the organization's financial position. For example, if the market value of a company's land has increased since it was purchased, current value accounting would reflect this increase in value on the balance sheet.

Another advantage of current value accounting is that it can provide useful information for decision-making. By using current market values, an organization can better understand the impact of changes in market conditions on its financial position and make more informed decisions. For example, if the market value of an organization's investments has decreased significantly, it may be necessary to reevaluate the investment strategy.

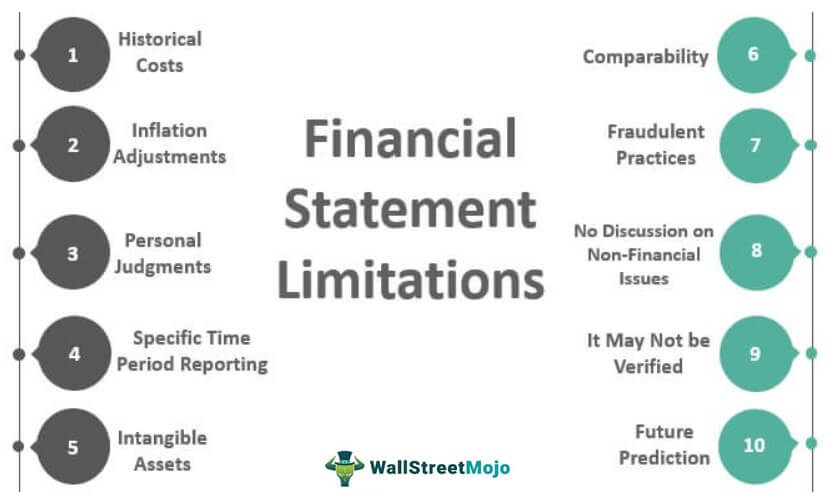

However, there are also some disadvantages to current value accounting. One disadvantage is that it can be subject to greater volatility and uncertainty. Market values can fluctuate rapidly, which can make it difficult to accurately estimate the current value of assets and liabilities. This can lead to greater variability in the financial statements and make it more difficult for investors and other stakeholders to understand the organization's financial position.

Another disadvantage of current value accounting is that it can be more expensive and time-consuming to implement. Estimating the current value of assets and liabilities requires the use of specialized valuation techniques and the input of external experts, which can increase the cost and complexity of the accounting process.

In conclusion, current value accounting has both advantages and disadvantages. While it provides a more accurate representation of an organization's financial position and can be useful for decision-making, it can also be subject to greater volatility and uncertainty and may be more expensive and time-consuming to implement. As with any accounting method, it is important to carefully consider the benefits and limitations of current value accounting and determine whether it is the most appropriate approach for a given organization.

:max_bytes(150000):strip_icc()/Term-a-accounting-conservatism_Final-e501ce15a804454a959b3f860a90daf9.png)

:max_bytes(150000):strip_icc()/cost-accounting-0dae1cc4dd244312acc871e8895f6402.jpg)