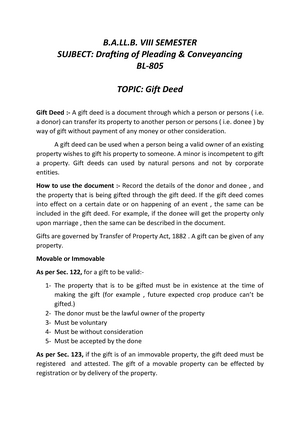

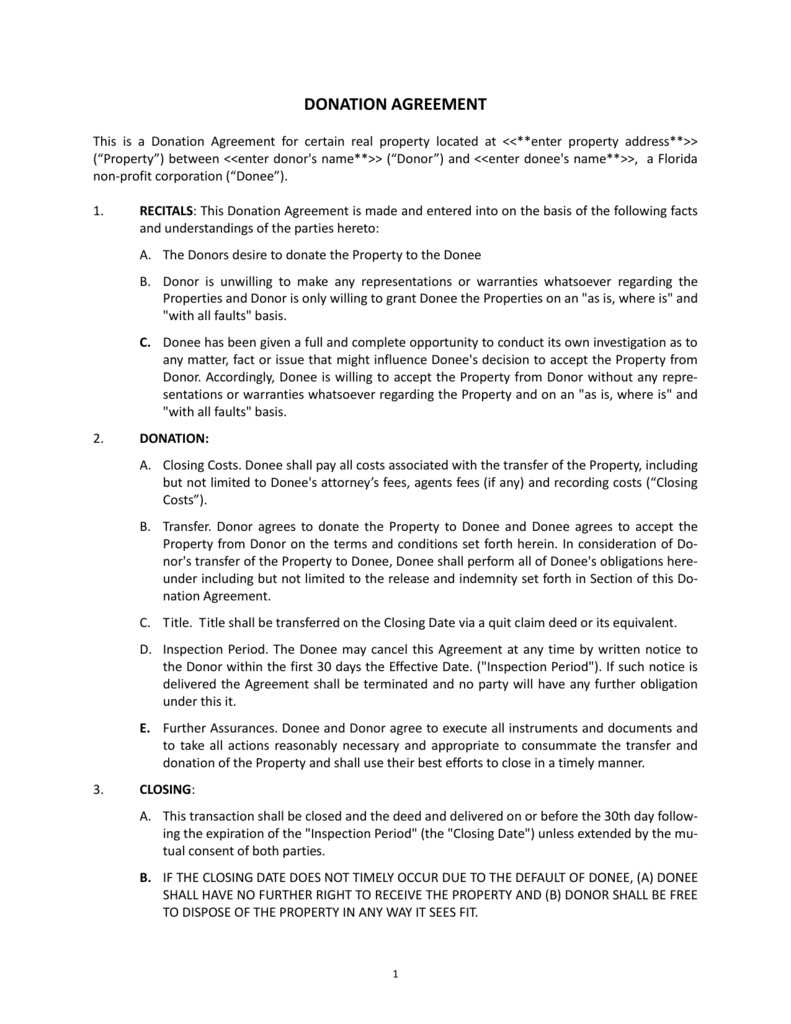

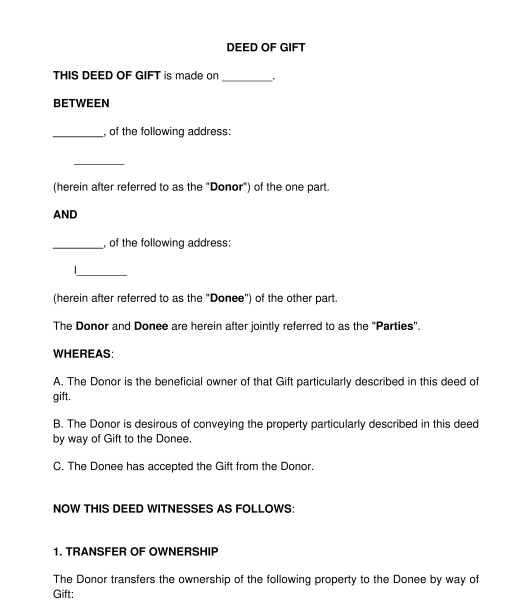

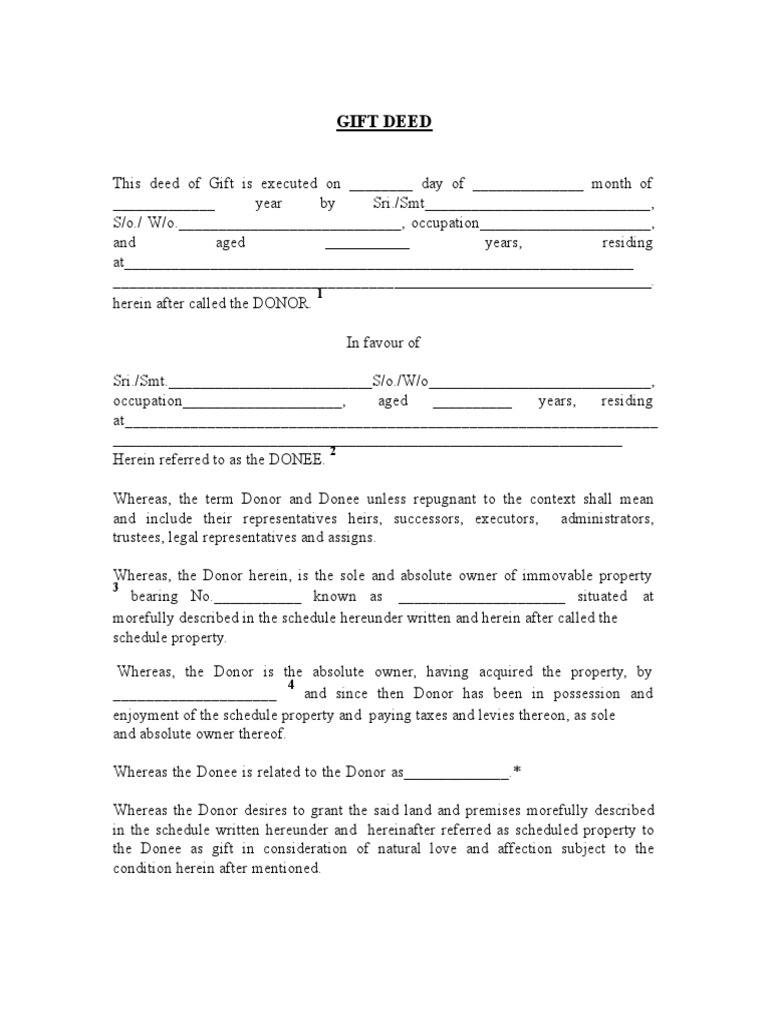

A gift deed is a legal document that outlines the transfer of ownership of a gift from the donor to the donee. In this context, the donor is the person who is giving the gift, while the donee is the person who is receiving the gift.

There are several key aspects of the donor and donee relationship that are important to understand in the context of a gift deed.

First, it is important to understand that the donor must have the legal capacity to give a gift. This means that the donor must be of legal age and must have the mental capacity to understand the nature and consequences of the gift. If the donor does not have the legal capacity to give a gift, the gift deed may not be enforceable.

Second, it is important to understand that the donee must also have the legal capacity to receive a gift. This means that the donee must also be of legal age and must have the mental capacity to understand the nature and consequences of the gift. If the donee does not have the legal capacity to receive a gift, the gift deed may not be enforceable.

Third, it is important to understand that the gift must be given freely and without any form of coercion or undue influence. If the donor is under duress or is being forced to give the gift, the gift deed may not be enforceable.

Fourth, it is important to understand that the gift must be clearly identified in the gift deed. This means that the gift deed should specify what the gift is and should provide a clear description of the gift. If the gift is not clearly identified in the gift deed, it may be difficult to determine what the gift is and the gift deed may not be enforceable.

Finally, it is important to understand that the gift deed must be executed properly in order to be enforceable. This means that the gift deed must be signed by the donor and the donee, and it must be witnessed by at least two witnesses. If the gift deed is not properly executed, it may not be enforceable.

In summary, a gift deed is a legal document that outlines the transfer of ownership of a gift from the donor to the donee. It is important to understand the legal capacity of both the donor and the donee, as well as the requirement that the gift be given freely and without coercion or undue influence. The gift must also be clearly identified in the gift deed, and the gift deed must be properly executed in order to be enforceable.