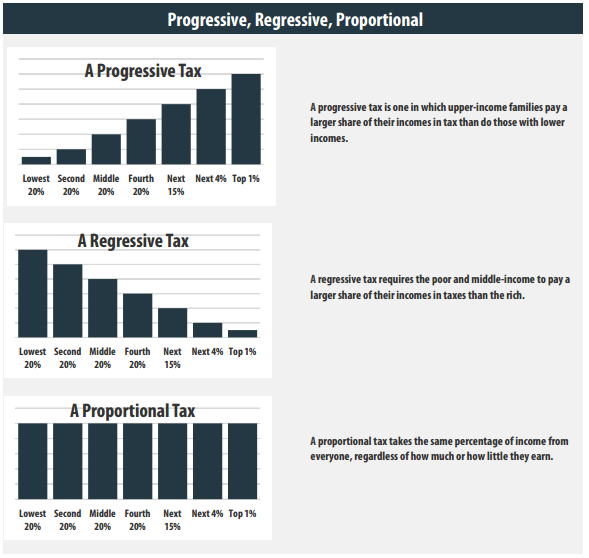

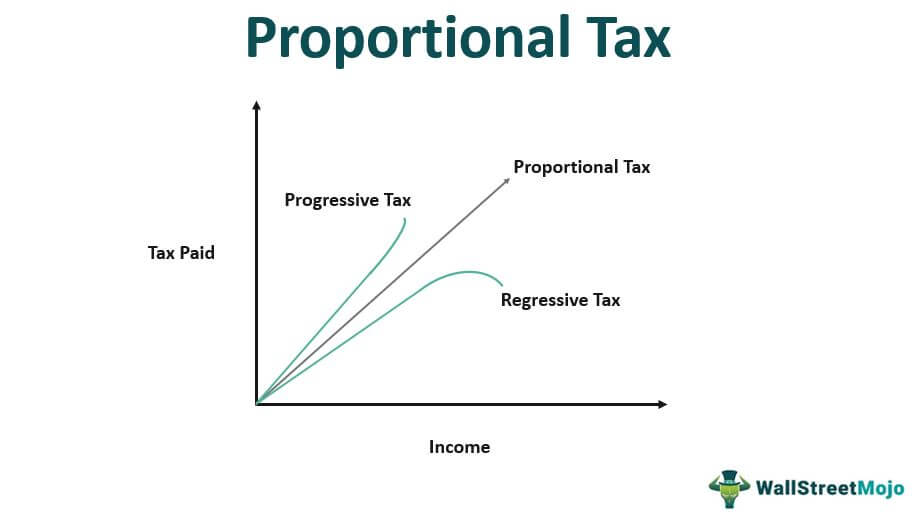

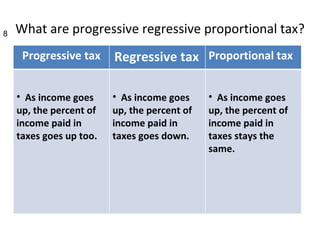

There are three main types of taxes: progressive, regressive, and proportional. Each type is characterized by how the tax burden is distributed among taxpayers.

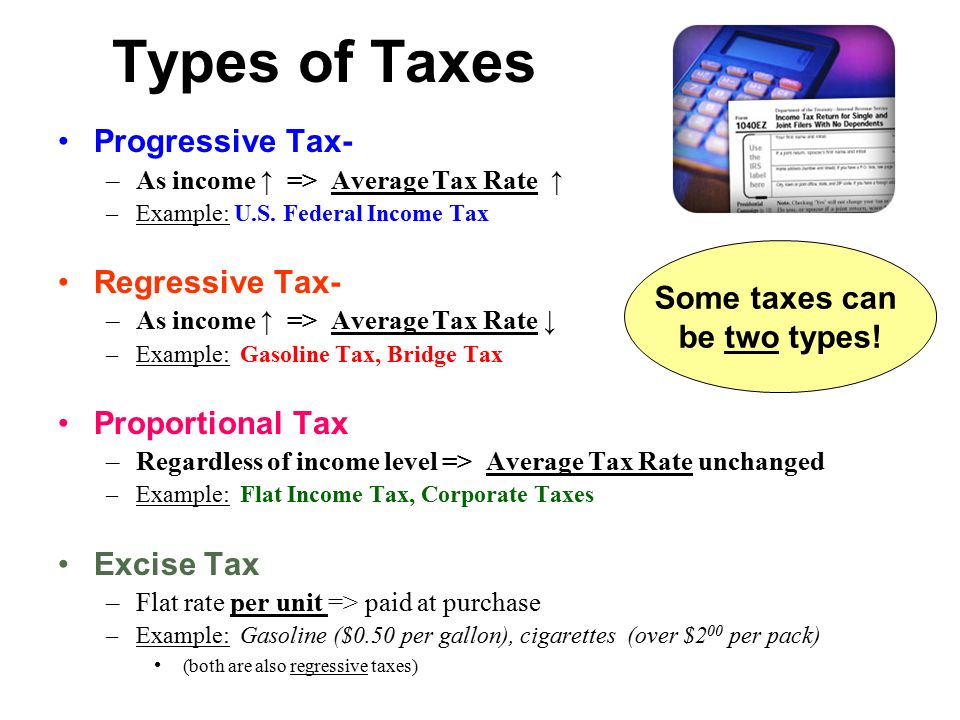

Progressive taxes are those in which the tax rate increases as the amount of income or wealth increases. This means that higher income earners pay a higher percentage of their income in taxes than lower income earners. Examples of progressive taxes include the federal income tax in the United States and the value-added tax (VAT) in many European countries.

One argument in favor of progressive taxes is that they help to reduce income inequality by taking a larger share of income from those who can afford it and redistributing it to those who are less well off. Progressive taxes can also help to fund public goods and services that benefit all members of society, such as education and healthcare.

On the other hand, some people argue that progressive taxes can be unfair because they penalize success and discourage people from working hard and earning more money. They may also discourage businesses from investing and hiring new employees, as they may face higher tax rates as they grow and become more successful.

Regressive taxes are those in which the tax rate decreases as the amount of income or wealth increases. This means that lower income earners pay a higher percentage of their income in taxes than higher income earners. Examples of regressive taxes include sales taxes and excise taxes on certain goods and services, such as gasoline and tobacco.

One argument in favor of regressive taxes is that they are relatively simple and easy to administer. They also provide a stable source of revenue for governments, as they are not as sensitive to economic fluctuations as progressive taxes.

However, regressive taxes can be criticized for being unfair because they disproportionately affect low-income earners, who may have less disposable income to begin with. Regressive taxes may also contribute to income inequality, as they take a larger share of income from those who can least afford it.

Proportional taxes are those in which the tax rate is the same for all taxpayers, regardless of their income or wealth. This means that everyone pays the same percentage of their income in taxes. An example of a proportional tax is the flat tax, which has been proposed in various countries as an alternative to progressive and regressive taxes.

One argument in favor of proportional taxes is that they are fair and simple, as everyone pays the same rate regardless of their income. They may also encourage economic growth and investment, as businesses and individuals face the same tax rate regardless of their level of success.

However, proportional taxes can be criticized for being regressive in practice, as they may take a larger share of income from low-income earners who have less disposable income to begin with. They may also be less effective at reducing income inequality and funding public goods and services, as they do not take into account the ability of high-income earners to pay more in taxes.

In conclusion, progressive, regressive, and proportional taxes are all different ways of distributing the tax burden among taxpayers. Each type has its own advantages and disadvantages, and the best approach may depend on the specific goals and circumstances of a given country or jurisdiction.